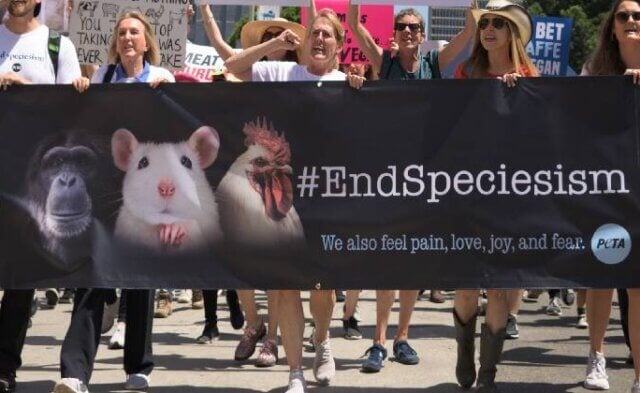

What do retirement accounts and life insurance have in common? If you are less than enthused by this question, we need to talk—this is exciting stuff! They are both great ways to give PETA a stronger voice for animals in the future. They generally aren’t covered by wills or trusts, and the paperwork to specify PETA as the beneficiary is simple, so simple that I could do it myself in two minutes-and I did. But why?

What do retirement accounts and life insurance have in common? If you are less than enthused by this question, we need to talk—this is exciting stuff! They are both great ways to give PETA a stronger voice for animals in the future. They generally aren’t covered by wills or trusts, and the paperwork to specify PETA as the beneficiary is simple, so simple that I could do it myself in two minutes-and I did. But why?

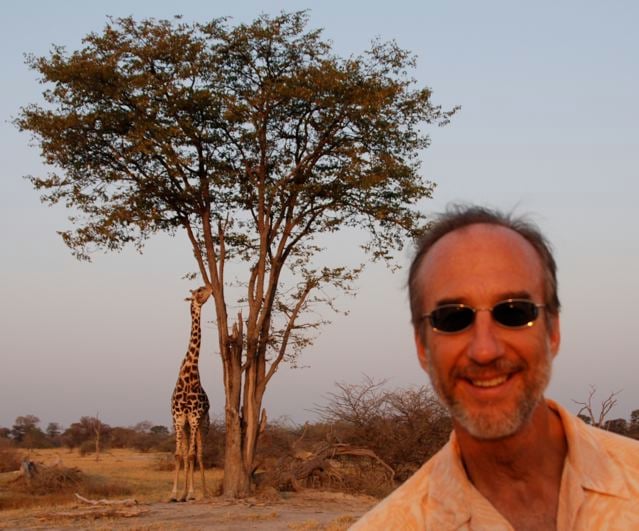

No group in the world fights harder for animals now and will in the generations to come than PETA, and I want to support that fight. We see progress every day, but this important work will surely not be finished when I am. And I want my money to stand for what I stand for. As a bonus, I really like the members of PETA’s Augustus Club, who are all taking this position and are making a huge difference in the world. I am proud of and thankful for them, and I’m pleased to be among their ranks.

The following are three ways that life insurance can give animals a future by funding PETA:

1) Many policies have outlived their function or are unnecessary for providing a future for loved ones. For these, it is a simple matter to change the beneficiary to PETA. For example, people often buy life insurance when they have young children or when they buy their first house to provide for their families if the worst happens. But now, many years later, the house is paid off or downsized, the kids are self-sufficient adults, and other assets are available for the family. Or maybe you have no kids, no significant other, and no one who should get rich when you die. And many people are covered by life insurance provided by their employers as a free benefit but don’t need the coverage. Or you might have travel insurance that you can donate to animals by specifying PETA as the beneficiary. See what I mean? So take a moment to review your personal situation.

2) Life insurance also provides a fabulous way to multiply your donations. A relatively small annual premium can fund a policy with a death benefit many times greater than you could afford to leave PETA outright. You’d be surprised, I think, to know how big a death benefit you can buy with an annual payment within your budget. If PETA is the owner and beneficiary of the policy, you might even be able to deduct the payments from your income taxes.

3) There is a life insurance strategy that sounds like it’s only for billionaires, but it can actually work for many folks. It’s called wealth replacement (even if you don’t consider yourself wealthy). Let’s say that you want to leave a chunk of assets to PETA but also want to provide for a loved one when you’re gone. The idea is that life insurance to benefit your loved one can be used to replace money donated to PETA through a will, trust, annuity, or current gift. The insurance is paid for by money saved on taxes from the gift to PETA, and/or by income from the trust or annuity.

As I mentioned, the paperwork for making PETA the beneficiary of life insurance or retirement plans is generally quite simple. But you do need to include some specific information, so please get in touch with us if you want to pursue any of these ideas. We can help you.

Everyone is unique and has special circumstances to consider when setting up a plan for the future. Please consult with competent and trustworthy counsel before making these kinds of decisions. But as Ben Franklin said, “In this world, nothing is certain but death and taxes.” We can’t beat death, but donations to PETA are tax deductible. And we can continue to save animals beyond our lifetimes.