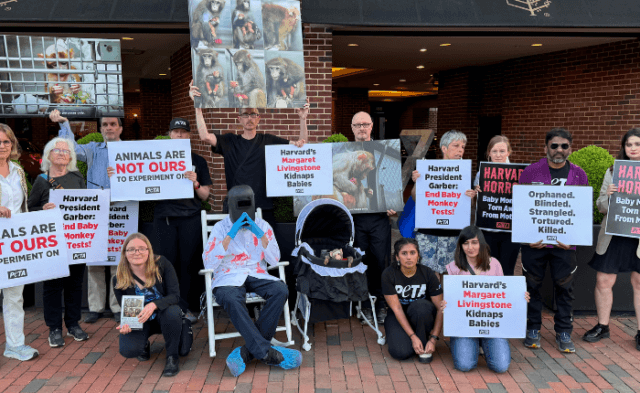

What kind of world do you want to live in? Whether the market is up, down, or holding steady, investing in a kinder future for animals is always an enlightened choice. You can make a difference for animals and lower your taxes by donating part of your individual retirement account (IRA) assets to support PETA’s mission through a qualified charitable distribution (QCD). Talk about feeding two birds with one scone!

In most cases, when you withdraw funds from your IRA, you’ll have to pay taxes. But with a QCD, the transfer won’t count as taxable income, making it an appealing, tax-efficient way of donating to a charity. Another benefit is that the amount you transfer won’t count as income for the year, which may help keep you in a lower tax bracket.

If you’re at least 70½ years young, you can make a tax-savvy QCD from your IRA directly to PETA. You can donate up to $100,000 (or $200,000 for a couple) per year. Once you reach 72, IRS rules require that you take annual minimum distributions from your tax-deferred retirement accounts. Your QCD can help you reach your minimum requirement while making the maximum difference for animals.

You can also designate PETA as the beneficiary of your IRA account, allocating the remaining funds (or the amount you specify) to us and leaving a legacy that supports our groundbreaking work to end cruelty to animals.

Please contact Tim Enstice at [email protected] if you have any questions or to let us know about your gift.

Ready to Get Started? Learn How to Initiate Your QCD GiftBy joining your fellow PETA supporters who have created tax-free IRA gifts, you’ll boost our vital work to prevent animals from being abused and help make the world a kinder place for all sentient beings.

Please let us know that you’ve made a gift at [email protected] or 757-962-8213 so that we can thank you and ensure that you’ll receive the appropriate IRS acknowledgment.