Fall is here, so you know what that means: It’s time to indulge in pumpkin spice everything, break out the wool-free sweaters, and celebrate the passage of the War Revenue Act, which turns 100 on October 3. What? You’ve never heard of it? Well, go fix yourself a vegan Pumpkin Spice Latte (we’ll wait) and then read on to find out why the act matters and how it can help you help animals.

Our story starts with the passage of the 16th Amendment in 1913, which gave the U.S. government the power to levy income tax on individuals for the first time. Fast forward to 1917, the year that the U.S. entered World War I. In order to raise money for the war effort, Congress passed the War Revenue Act of 1917, which increased individual tax rates to unprecedented levels. But because of concerns that higher tax rates would dampen charitable giving, policymakers had the forethought to include a provision making contributions to charities tax-deductible. This is kind of a convoluted way of saying that if you’re a U.S. citizen, your donations to PETA could earn you a break on your taxes.

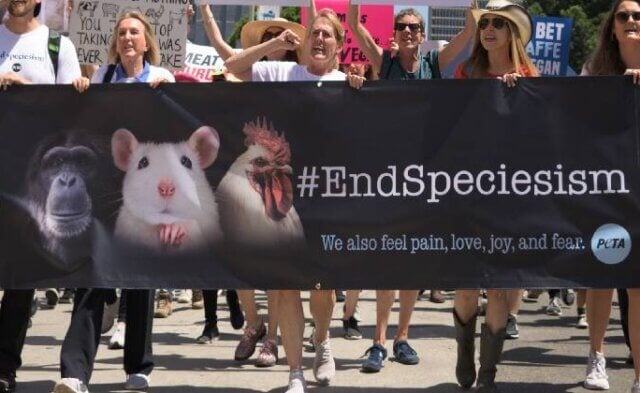

Whether it’s sweater weather or not, PETA relies on caring people like you to help us make a difference in animals’ lives. From shutting down Ringling Bros. circus and rescuing animals struggling to survive in the aftermath of hurricanes and other disasters to exposing horrific experiments taking place inside university laboratories, coming up with creative ways to encourage consumers to choose vegan meat and fabrics, and much more, PETA—backed by you—is getting things done every day. We simply could not accomplish so much without your help. And remember: Thanks to the lawmakers of 1917, your donation could be tax-deductible!