Get Your Hands on an ‘Ethically by PETA’ Box Before It’s Too Late!

PETA has collaborated with some of our favorite companies to release another Ethically by PETA box. Act quickly, because this limited-edition item will sell out!

PETA has collaborated with some of our favorite companies to release another Ethically by PETA box. Act quickly, because this limited-edition item will sell out!

When salespeople knocked on my door a year ago to sell me solar panels, I initially declined, explaining that I couldn’t afford them and that I was already doing my part to combat the climate catastrophe by being vegan.

Just in time for summer, PETA Prime offers humane tips on how to keep ants outside the house without using toxic chemicals.

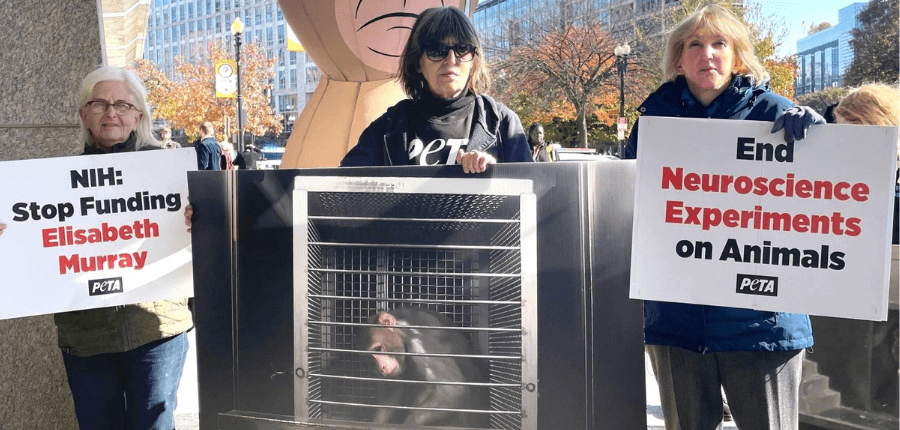

Harvard alums attending a lavish event in Washington, D.C., were greeted by a powerful PETA demo.

Here is this week’s list of easy daily actions you can do to make a difference for animals. We hope that every week you’ll spend a few minutes taking some of these quick actions!

Learn how one birthday celebration helped raise more than $3,000 for animals!

Please take action to urge NIH to cut off funding for cruel and painful Column E animal experiments.

Take Action